Connexity’s view on 2021 and beyond

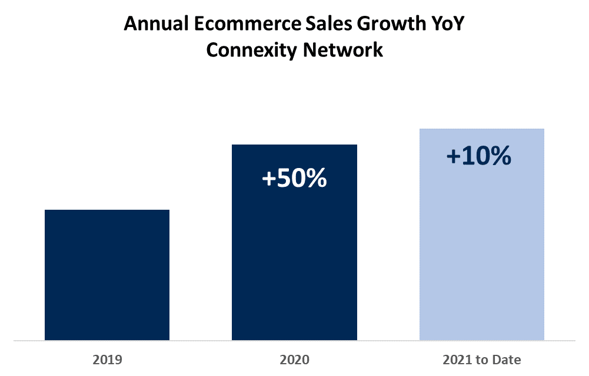

Many plans for 2021 were pinned on the hope that consumers would resume expected patterns of shopping and spending as we achieved a post-COVID norm. However, as much as Connexity campaigns represent a microcosm of the larger ecommerce industry, our data shows that 2021 didn’t go as expected. The old norms were broken and new stories about retail marketing are emerging.

Peak Period Shifts

Consumer spending during this year’s Black Friday and Cyber Monday, long iconic milestones marking the start of holiday shopping, was down when compared to 2020. While still strong in comparison to the average day, the new story that kicked off the holiday season is that shoppers shifted their activity forward and spent more (much more) in the weeks leading up to Black Friday and Cyber Monday than in previous years.

These results make sense as we know external market research in Q3 indicated 61% of consumers began shopping way ahead of Thanksgiving day, much earlier than consumers have typically done in the past. We can attribute this shift to a number of things, but particularly to:

- Supply chain issues increased anxiety about availability and drove holiday buyers to shop earlier.

- Retailers tried to recoup lost profits, and moved promos and discounts forward to capture sales earlier over a longer time span.

- Constant fear of inflation in the U.S. leading consumers to be more conservative about their spending habits.

Crushing It with Context

With typical social, search and shopping portals saturated by offers, retailers are focusing additional budget on sources of publisher content with contextual placement opportunities. These sources hold the promise of delivering incremental exposure and reaching shoppers in high-intent settings.

In the Connexity network we observed a roughly 50% increase this year in ad spend to placements on contextual content sources. These shifts to reach consumers in content aligned with category interests paid off. Sales volume from contextual content placements increased nearly 70% in 2021 vs last year.

Peak Period Shifts

Consumer spending during this year’s Black Friday and Cyber Monday, long iconic milestones marking the start of holiday shopping, was down when compared to 2020. While still strong in comparison to the average day, the new story that kicked off the holiday season is that shoppers shifted their activity forward and spent more (much more) in the weeks leading up to Black Friday and Cyber Monday than in previous years.

These results make sense as we know external market research in Q3 indicated 61% of consumers began shopping way ahead of Thanksgiving day, much earlier than consumers have typically done in the past. We can attribute this shift to a number of things, but particularly to:

- Supply chain issues increased anxiety about availability and drove holiday buyers to shop earlier.

- Retailers tried to recoup lost profits, and moved promos and discounts forward to capture sales earlier over a longer time span.

- Constant fear of inflation in the U.S. leading consumers to be more conservative about their spending habits.

Our Bold Predictions

In 2022 consumers will continue to break the norms that retailers and the market have put in place for them. Gone will be the days of searching for products in the same traditional portals and shopping spaces. The open web will flourish and consumers will shop in places they haven’t thought of before. The power shifts back to the hand of the consumer and it’s up to businesses to figure out how to capture them.

Retailers will need to seize opportunities to reach shoppers where they’re inspired. Interest-based marketing will be a stronger focus. More budget will be spent in channels of contextual social influence and especially in sources of professionally published contextual content.

With the market headed toward a world without 3rd party cookies, retail advertisers will increasingly turn to 1st party data solutions to drive marketing optimization. Reaching the right shoppers, those showing high-intent within key product categories, requires precise selection of traffic sources with these audiences. We think 1st-party data will increasingly be the answer.

Recommendations for 2022

Plan Ahead

Seasonal events and typical trends for product categories may not matter as much as before. If 2021 showed us anything it’s that consumers drive demand when and where they want, despite the scheduled events that advertisers or the markets set. This is particularly challenging to retailers as budgets for certain categories or items have been determined ahead of time, and shifts in consumer trends are difficult or nearly impossible to predict.

Our suggestion is to be flexible and ready to shift your ad spend to new opportunities as they open. You need to stay ahead of the curve by spotting shifts in trends early. A marketing partner with visibility into millions of shoppers across many categories can deliver that early view and can adjust budget in real-time, quickly taking advantage of quality sources of shopper traffic to ensure maximum performance.

Find Contextual Opportunities

Consumers are savvy and they know how to find what interests them online. For nearly any interest category there are plenty of online sources on the open web, outside of mainstream social, search and shopping portals that offer content capturing the attention of consumers looking for inspiration.

Your promotions may be more compelling within content that is contextual. As the standard destinations for shopping are flooded with product offers, contextual content on the open web offers incremental opportunities to reach interest-based audiences. Exposure in traffic aligned with an audience’s category interests can drive more impressions to your site. Even where a link may land the visitor on category or sales pages, instead of a specific product offer, this can result in higher average order values from exposure to a broader range of products and promo offers.

Empower Your Data

Taking advantage of contextual opportunities may mean finding 1st party data solutions. Data about how shoppers interact with your site and products can increase campaign performance. First party data holds the information necessary to define your ideal shopper interests. It’s these interest patterns that are the keys to finding more new customers that look like your shoppers.

Retail advertisers need to find ways to empower 1st party data. Look for opportunities where your shopping data can be an ingredient in the recipe for optimization. Campaign optimization using shopping data can prioritize high-quality traffic placements that reach new audiences who have shopping patterns matching your best customers.

Suggested Read: Why The Risk Of First-Party Data Could be A Net Win for Brands And Retailers

For more information about retail performance marketing, contextual targeting and empowering your first-party data, contact Connexity.